According to the Notice of the General Administration of Customs No. 136 of 2019 (Announcement on the Promulgation of the Measures for the Administration of the Origin of Import and Export Goods under the Framework Agreement of the Customs of the People's Republic of China on the Comprehensive Economic Cooperation between the People's Republic of China and the Association of Southeast Asian Nations) The new FORM E certificate will be activated on August 20, 2019.

(▲New filling requirements)

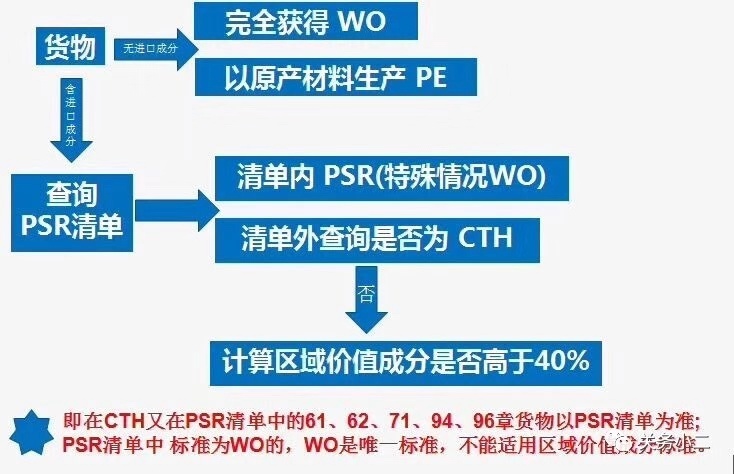

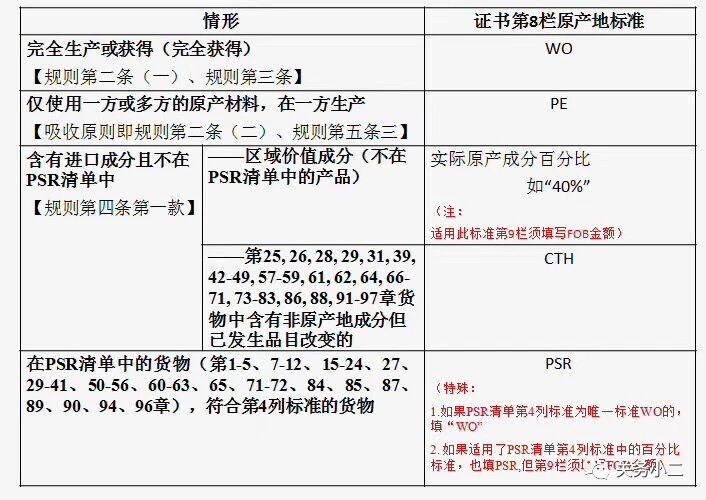

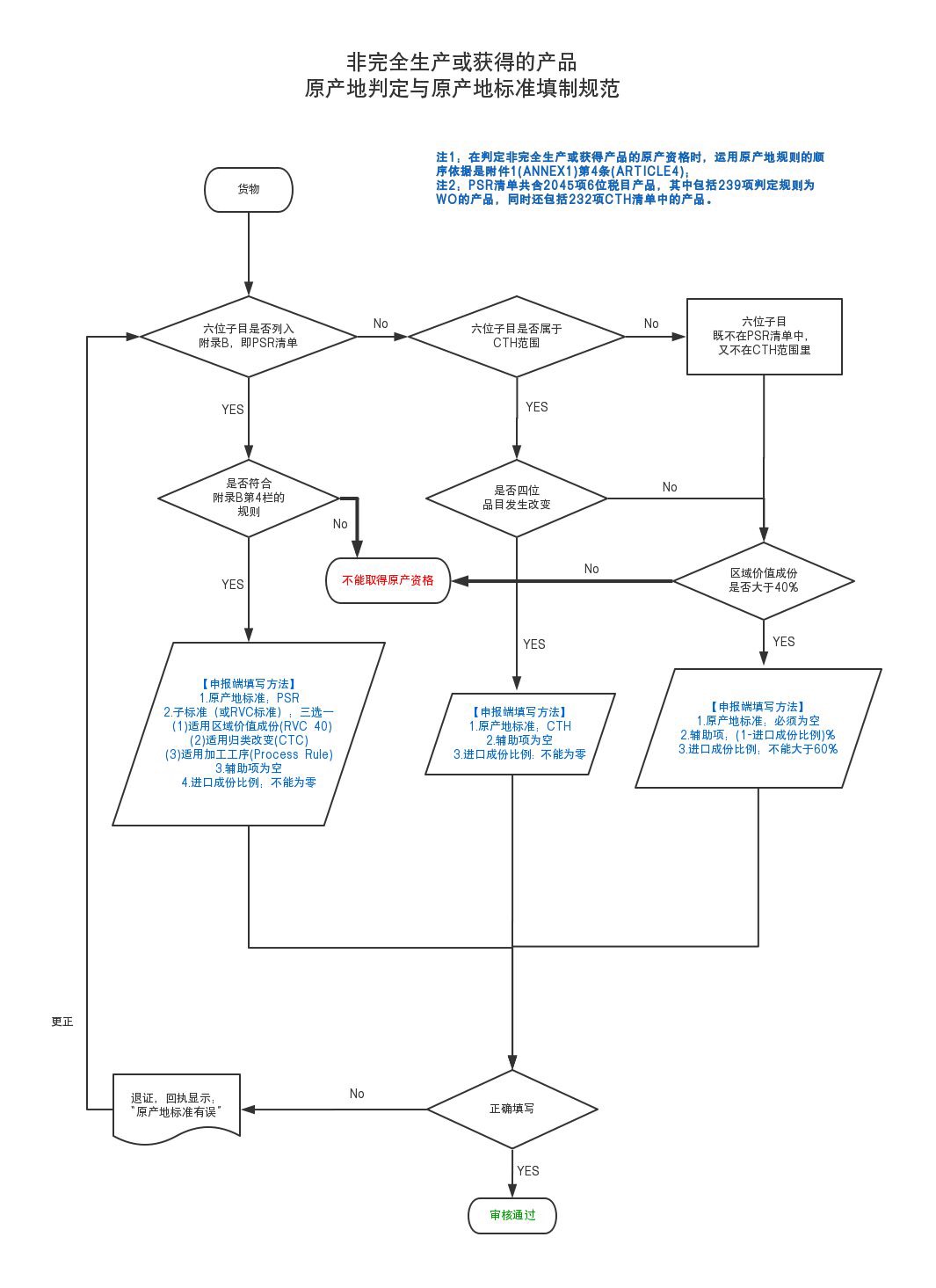

Guidelines for the filling of origin standards

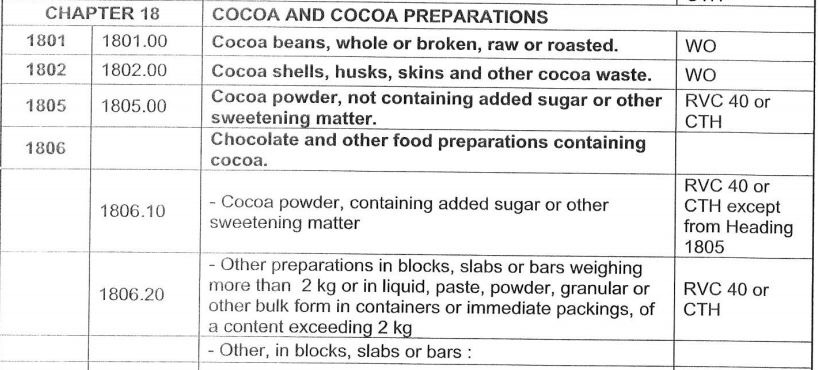

It should be noted that the PSR list of specific origin standards is more than before, from the original only 17 chapters to the coverage of 57 chapter products, including imported components, the first checklist is not in the PSR list.

Reply "PSR" in the public number dialog box

Get the upgraded PSR list

CTH Remarks:

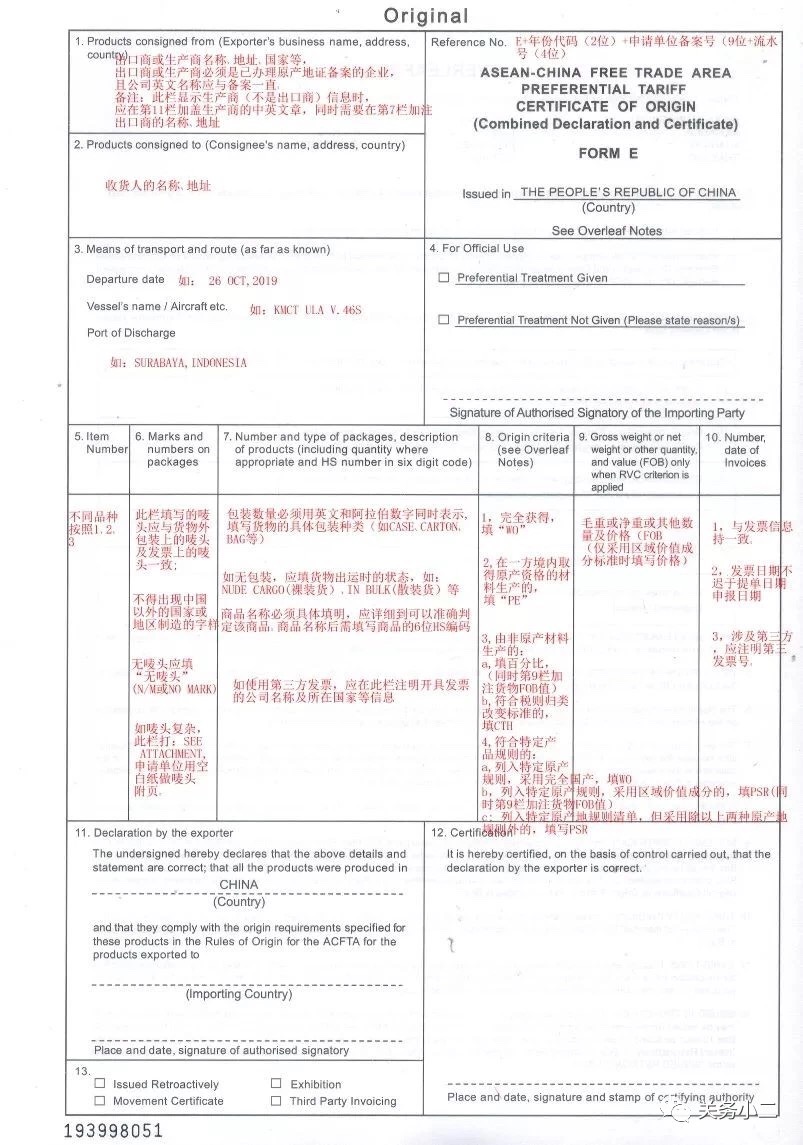

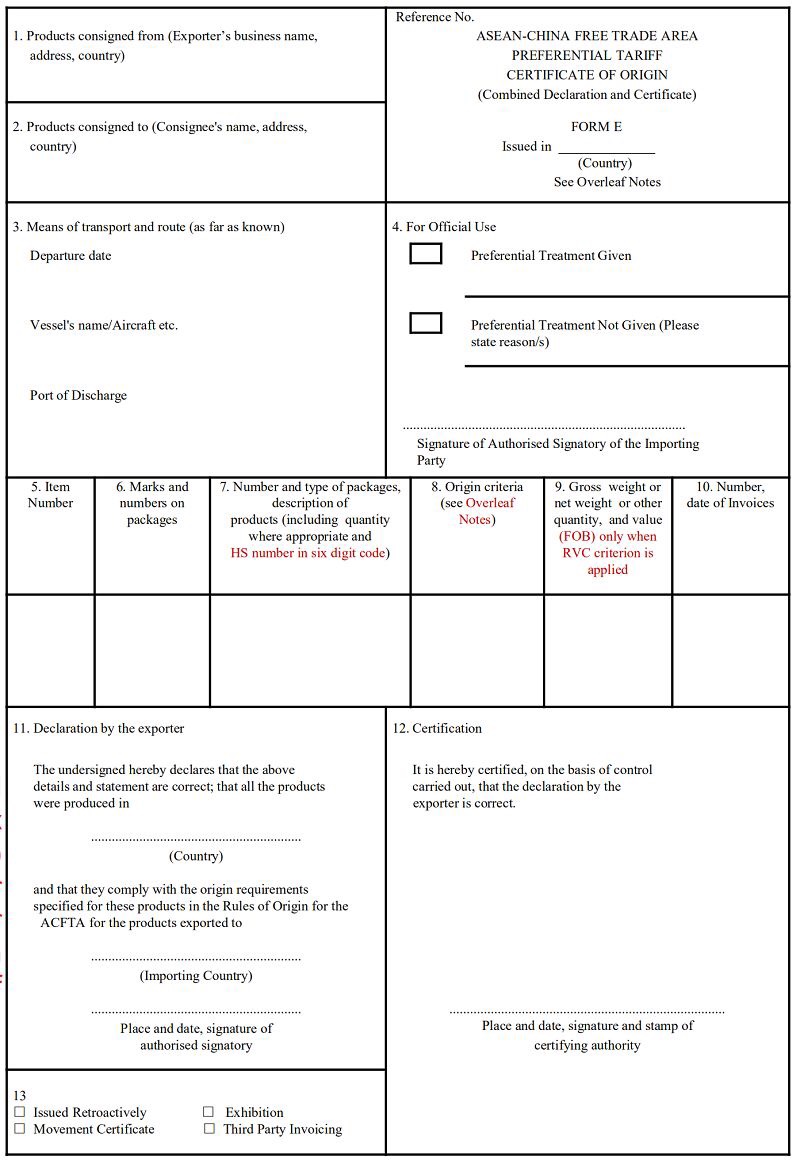

New version of FORM E certificate of origin

The China-ASEAN Free Trade Area Preferential Certificate of Origin (hereinafter referred to as the FORM E certificate) has 13 columns, and the requirements for filling each column are as follows:

Certificate of Origin:

In the title bar (upper right corner), fill in the certificate number specified by the customs. The numbering rules are as follows: E+ year code (2 digits) + application unit record number (9 digits) + serial number (4 digits).

For example: the certificate number E193800000050045 is the 45th FORM E certificate issued by the unit with the record number 380000005 in 2019.

Note: The number of the reissuance certificate is the same as the code of the new card, but the serial number is changed.

Column 1: Name, address, country of the exporter

E.g:

NINGBO XXX GROUP CO.,LTD.

ROOM XXX,XXX MANSION,

93 XXX ROAD,NINGBO CHINA

note:

1. Fill in the name, address, country, etc. of the exporter or manufacturer in China. The exporter or manufacturer must be an enterprise that has filed a certificate of origin, and the English name of the company should be consistent with the record. When this column displays information about the manufacturer (not the exporter), the manufacturer's Chinese and English chapters should be stamped in column 11, and the name and address of the exporter must be added in column 7.

2. Companies registered in Taiwan, Hong Kong and Macau cannot be exporters;

Column 2: The name, address, country of the consignee

E.g:

XXX CO.,LTD,

LAN GE XXX,F-2000,

SURABAYA,INDONESIA

Note: This column is mandatory and should be filled in with the ASEAN final consignee name, address, and country.

Column 3: Mode of transport and route (as far as known)

E.g:

离港日期(Departure date):26 OCT,2019

船舶名称/飞机等(Vessel's name/Aircraft etc):KMCT ULA V.46S

卸货口岸(Port of discharge):SURABAYA,INDONESIA

Column 4: For official use (used by the importing customs)

The customs authorities of the importing member party briefly state in this column whether preferential treatment is granted under the agreement. The applicant should leave this field blank.

Column 5: Product Sequence Number

In the case of the consignee and the same transportation conditions, as the batch export goods have different varieties, they can be classified into “1”, “2”, “3”, etc. according to different varieties, and so on.

Column 6: Taro and package number

E.g:

JENSON,

ORDER N0.325952065

LJCE766896505

CTN1-270

note:

1. The hoes in this column should be the same as the hoes on the outer packaging of the goods and the hoes on the invoices;

2. Shantou must not appear in the country or region outside China, nor can it appear in Hong Kong, Macao or Taiwan.(Such as:MADE IN MACAO,HONG KONG,TAIWAN);

3. If there is no hoe, the goods should be filled with "no hoe"(N/M或NO MARK);

4. If the skull is a more complicated content such as graphic text, this column is marked."SEE ATTACHMENT",The applicant unit will use the blank paper to make the attached page with the graphic, and the visa agency will stamp the visa seal;

5. For the case of multi-page certificates, the continuation page will always use Form E certificate, and white paper should not be used as the certificate continuation page.

Column 7: Quantity and type of packaging, product description and HS code

E.g:

SIX HUNDRED(600)CTNS OF SHRIMPS

H.S.:030613

**********

note:

1. The quantity of packaging must be expressed in both English and Arabic numerals, and the specific packaging type of the goods (such as CASE, CARTON, BAG, etc.).

2. If there is no packaging, please indicate the status of the goods when they are shipped, such as "NUDE CARGO" (naked goods), "IN BULK" (bulk goods), "HANGING GARMENTS" (mounted).

3. The name of the product must be specified and detailed, and the product should be accurately determined. If the letter of credit, the name of the contract is general or misspelled, a specific description or correct name should be added to the brackets. After the product name, you need to fill in the 6-digit HS code of the product.

4. After the item name and HS code are listed, a symbol (***) indicating the end should be added below the last line to prevent the forgery of the content.

5. The foreign letter of credit requires the filling of the contract, the letter of credit number, the invoice number issued by the re-exporter, etc., which can be filled in the blank space under the terminator.

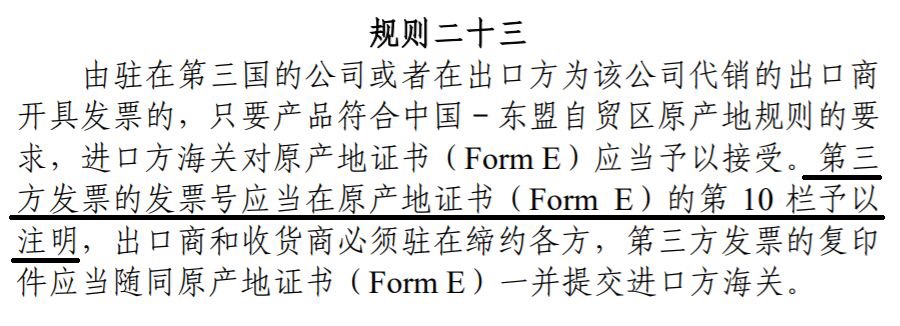

6. If the goods exported to ASEAN member countries use third-party invoices when customs declaration in the importing country, the company name and country of the invoice should be indicated in the blank of this column, for example, "THE THIRD PART: ALTEAD CO.LTD , HONGKONG". The third party must be a third party company outside of China and not a domestic company.

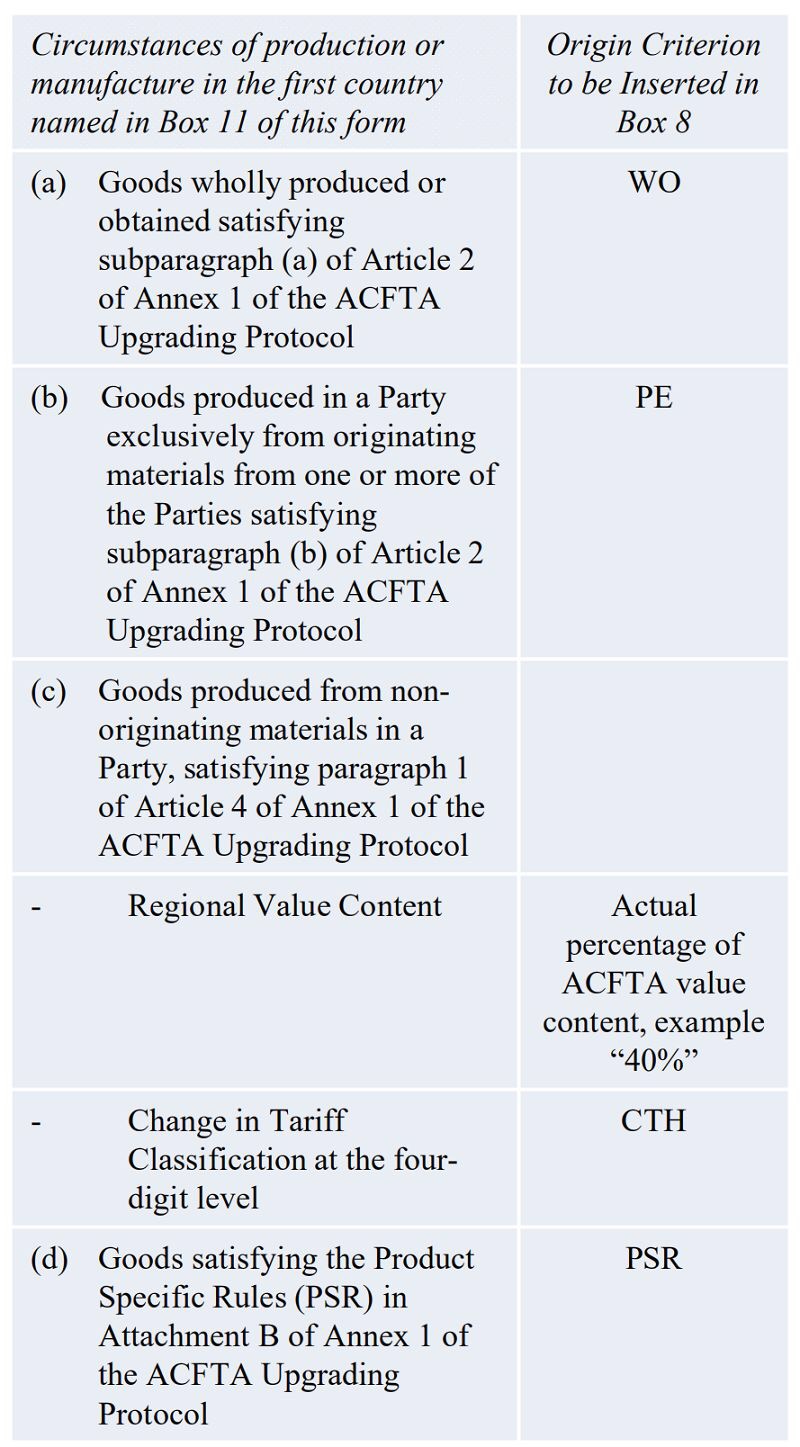

Column 8: Origin criteria

This column is the core column of the certificate of origin. The filling requirements are as follows:

1. Completely, fill in "WO".

2. If it is produced by a material that has obtained the original qualification in one territory, fill in “PE”.

3. Produced from non-original materials,

a: In accordance with the regional value component standard, that is, the single country component or the cumulative component of the China-ASEAN Free Trade Area is greater than or equal to 40% of the FOB price of the product, the percentage of value added should be filled, for example, “40%” (and the column 9 needs to be added) Note the FOB value of the goods);

b: If the tax classification is changed to the standard, fill in CTH.

4. In accordance with the specific product rules,

a: list the specific rules of origin, but if you fully obtain the rules of origin, fill in ""WO";

b: list the specific rules of origin, but if the rules of origin of the regional value component are used, fill in the PSR (at the same time, the column 9 must be filled with the FOB value of the goods);

c: List the specific rules of origin, but use the PSR in addition to the above two rules of origin.

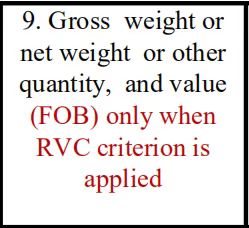

Column 9: gross weight, net weight or other quantity and price (FOB) (fill in price only when using regional value component criteria)

E.g:

1200KGS G.W.

note:

1. This column should fill in the normal unit of measurement of the goods, such as "PCS", "PAIRS", "SETS" and so on. If the weight of the goods is gross or net weight, G.W. (GROSS WEIGHT) or N.W. (NET WEIGHT);

2. For the case where the country of origin standard uses the regional value component standard, this column needs to display the FOB value of the product, and the rest of the situation does not need to fill in the amount.

Column 10: Invoice number and date

E.g:

SDAKFO522

MAY 05,2019

note:

1. This column must not be left blank. The invoice number and date must be consistent with the official commercial invoice. The month is generally indicated by the English abbreviation JAN., FEB., MAR, etc.

2. The invoice date cannot be later than the bill of lading date and filing date;

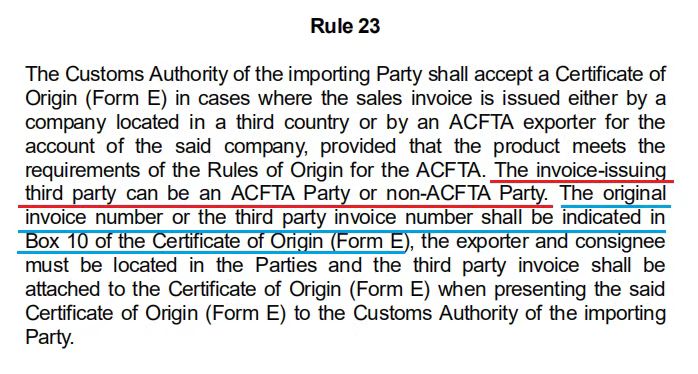

3. For third parties involved, the third party invoice number should be indicated.

Column 11: Exporter's Statement

E.g:

Ningbo,China OCT.26,2019

note:

1. The name of the country of production should be filled in “CHINA”. The name of the country of import must be a member of ASEAN, generally in line with the country of the final consignee or port of destination. Visa national cuisine, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam.

2. Fill in the declaration location and date in this column. The applicant should stamp the column and authorize someone to sign it in this column. When the production enterprise (non-exporter) is the application unit, this column is stamped with the seal of the production company.

Column 12: Visa agency certification

E.g:

Ningbo,China OCT.26,2019

note:

1. Fill in the visa office location and date in this column;

2. The visa authority authorizes the visa personnel to sign in this column, and stamp the “Chinese and English visa seal” on the original and copy of the certificate provided to the applicant. The seal should be clearly stamped and cannot overlap with the signature. The handwritten handwriting of the visa officer must be filed with ASEAN through the General Administration of the General Administration, and the signature must be clear and consistent with the written handwriting;

3. In the case of a reissue certificate, the visa agency adds ""CERTIFIED TRUE COPY OF THE ORIGINAL CERTIFICATE OF ORIGIN NUMBER____DATED____")

Column 13:

This column is a check-out item for four items: post-issuance, exhibition, mobile certificate and third-party invoice.

note:

1. Post-issuance certificate: The filing date is three days after the date of shipment, and check "Issued Retroactively";

2. Involving the mobile certificate: Check "Movement Certificate".

3. Exhibition Certificate: When the product is shipped from the exporter to the other party and sold to one party during or after the exhibition, check "Exhibition". The name and address of the exhibition should be indicated in the second column.

4. Third Party Invoice: When the invoice is issued by a third party, check "Third Party Invoice".

other instructions:

1. Any unit applying for the China-ASEAN preferential certificate of origin must file a record at the local customs office.

2. If the original certificate is lost or damaged, the applicant unit may apply to the original visa agency for reissue, and provide a copy of the written instructions and the original certificate of the application unit and the losing party, and will be reissued after verification.

3. When the content of the FORM E certificate needs to be changed, an application for change must be provided. After the visa personnel have reviewed it, the wrong item on the certificate will be drawn in a horizontal line, and the correct content will be handwritten or printed in the blank space next to it, and the correct content will be added. *" The cut-off character, signed by the visa officer, stamped with the visa seal.

What changes have been made to the new FORM E certificate?

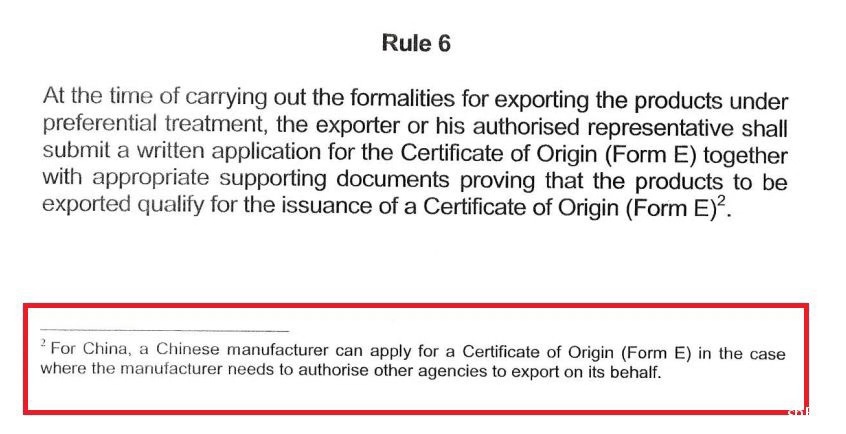

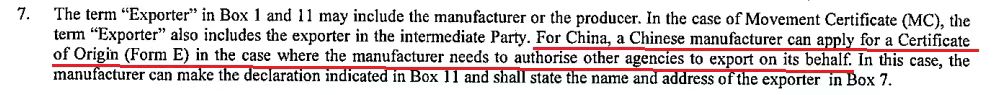

As far as China is concerned,

If you need to authorize other agents to represent their exports,

Chinese manufacturers can apply directly for a certificate of origin.

Appendix A of the Protocol, “Revised Procedures for the Visa Operation of the Rules of Origin of the China-ASEAN Free Trade Area” (hereinafter referred to as “Operating Procedures”)

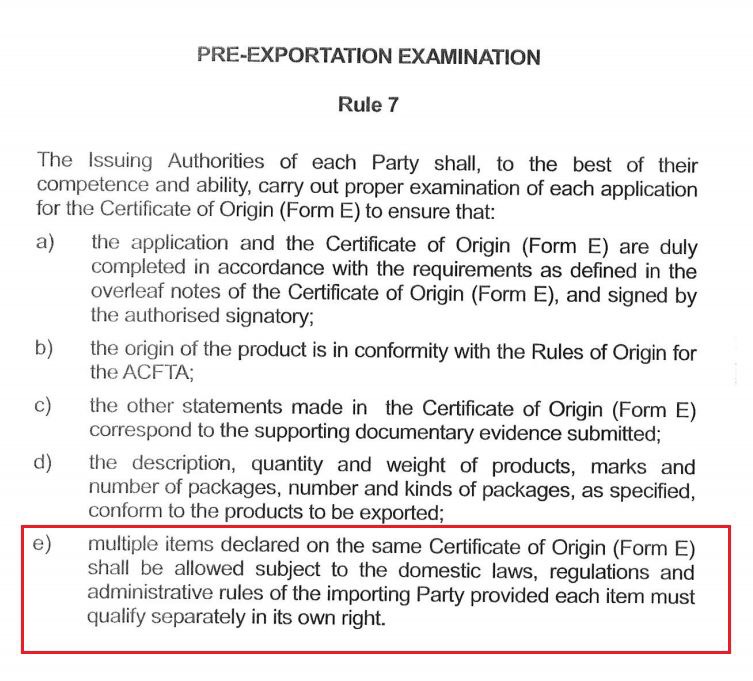

The new version of the original certificate page description Article 7

In the eleventh column, the manufacturer needs to make a statement, and the seventh column should fill in the name and address of the agent.

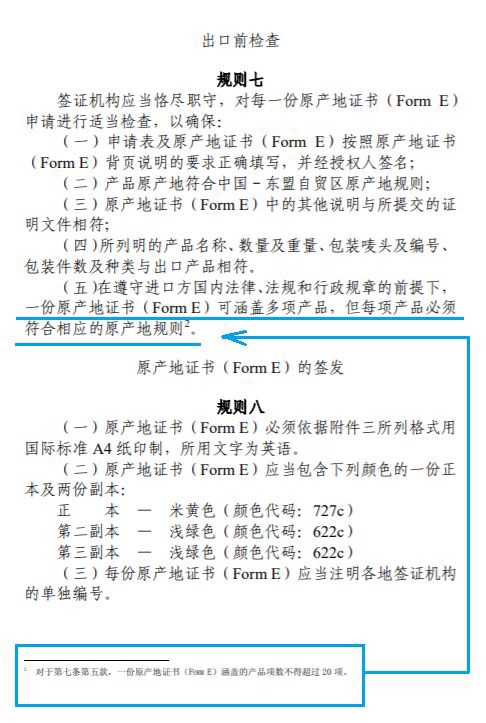

The FORM E certificate is no longer subject to the number of 20 items.

There is no need to split the invoice number to declare more miscellaneous goods.

"Operational Procedure" Rule 7 before "Upgrade":

"Upgraded" Operational Procedures (OCP) RULE 7:

Canceled the comment on 20 products

The continuation of the multi-page certificate must be consistent with the format, signature, stamp and number of the home page.

The rules of origin are more detailed,

The option for the origin criteria in column 8 of the certificate has been changed to five.

When the product is fully produced or obtained, the origin criteria in column 8 of the certificate shall indicate "WO" (agriculture, forestry, fishery and animal husbandry) or "PE" (except for agriculture, forestry, fishery and animal husbandry);

When the product is incompletely produced or obtained, the origin criteria in column 8 of the certificate shall indicate "PSR", "percentage of regional value component" or "CTH".

When using the rules of origin to determine the origin of a product, it is usually done in the following order:

1. In accordance with Articles 2 and 3 of the Protocol to the Protocol in Annex 1 of the Protocol, when determining the origin of a product, if the product meets the definition of full production or acquisition, it is not necessary to consider whether it meets the origin. The standard for products containing non-original ingredients; only products that do not meet the definition of full production or acquisition should be judged according to the criteria in Article 4 of the Rules of Origin. For example, tulip bulbs imported from the Netherlands, planted in the soil of China, cultivated flowers, exported to Malaysia, can enjoy preferential tariff treatment in the China-ASEAN Free Trade Zone? Since Article 3(a) of the Rules of Origin states that the complete production or acquisition of products includes “plant products harvested on the members' side;”, the tulips thus cultivated are completely native to China.

2. If the product does not meet the definition of full production or acquisition, the non-original component of the product must be determined according to the “micro-processing” or “under-processing” clause (negative standard) set in the rules of origin. Whether the processed process exceeds the scope of minor or insufficient processing. If it is not exceeded, the product does not have the original qualification; if it is exceeded, it is determined whether the product is included in the list of products covered by the Product Specific Rules, and if so, determine its Whether it meets the corresponding specific rules of origin (the regional value component is not less than 40%, the tax classification changes or the processing procedure rules), if it is met, the product has the original production qualification; if the product is not listed in the "Product Specific Rules" list, The origin of the product shall be determined in accordance with the general rules.

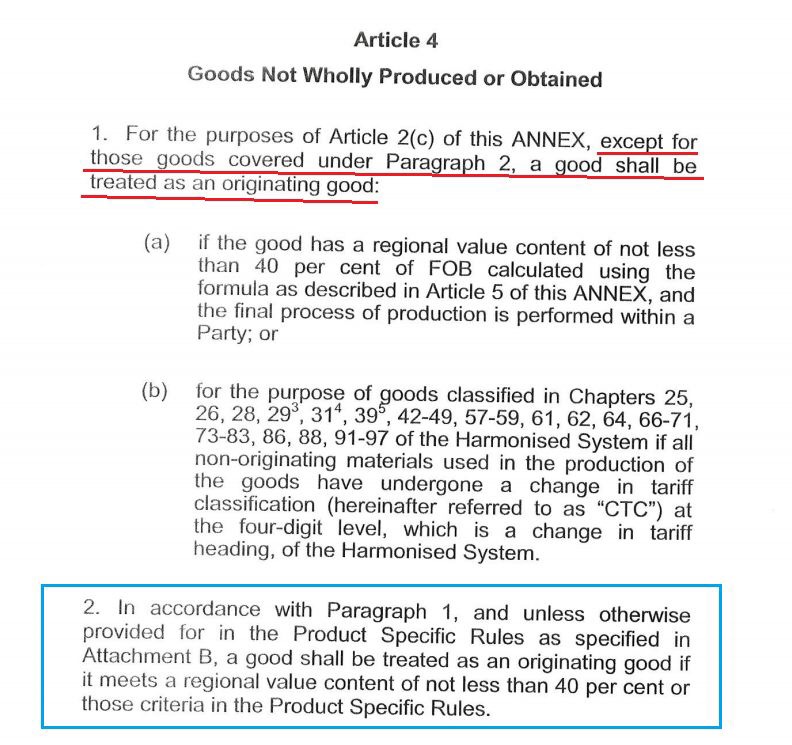

Article 4 of the Annex 1 (ANNEX1) Rules of Origin (Article 4) establishes new rules for the determination of incompletely produced or acquired products:

Article 4

Incomplete production or acquisition

1. Except for the products covered by paragraph 2, the following conditions shall be deemed to be the origin products referred to in Article 2(c) of this Annex:

(a) if the regional value of the product is not less than 40% of the FOB price calculated using the formula described in Article 5 of this Annex, and the final production process is carried out in one Party; or

(b) If the product is included in the Harmonized System, 25, 26, 28, 293, 324, 395, 42-49, 57-59, 61, 62, 64, 66-71, 73-83, 86, 88, 91- Chapter 97, and four items changed in non-original materials during the manufacturing process.

2. When the product is listed in the List of Product Specific Rules in Appendix B of the first paragraph, it shall be regarded as the original product if it meets the value of the regional value listed in the list of not less than 40% or other standards.

3 For Headings 29.01 and 29.02, the applied criterion is RVC 40%, unless otherwise mutually agreed by the Parties.

除非各协议方另有其他一致意见,品目号为29.01和29.02的产品,判定为原产的标准是区域价值成分不应少于40%。

4 For Headings 31.05, the applied criterion is RVC 40%, unless otherwise mutually agreed by the Parties.

5 For Headings 39.01, 39.02, 39.03, 39.07 and 39.08, the applied criterion is RVC 40%, unless otherwise mutually agreed by the Parties.

//////////

The legal provisions are very difficult. It is specifically stated here that the rules of origin are used in order to indicate the determination of products that are not fully produced or obtained. In accordance with the provisions of Article 4 of the Rules of Origin, paragraph 2 (special rules) shall apply first, and paragraph 1 (general rules) shall apply if not applicable.

(Note: each figure can be clicked to enlarge)

Column 7 should fill in the six sub-items of the product. The first six digits of HS coding are international standard codes, and countries can decide 7 to 10 national codes on their own. Most preferential certificate of origin requires the filling of the top six HS codes (the ECFA certificate is required to fill the 8-digit HS code of the importer).

Review the list of Product Specific Rules (Appendix B) and the results are as follows:

|

HS编码 及名称 |

适用特定原产地规则 |

证书第8栏 |

|---|---|---|

|

1801.00 生或炒 可可豆 |

WO (完全获得) |

不能获得 原产资格 |

|

1805.00 不含糖 可可粉 |

RVC 40 或 CTH |

PSR |

|

1806.10 含糖的 可可粉 |

RVC 40 或 CTH (非原产成分 不属于 品目1805) |

PSR |

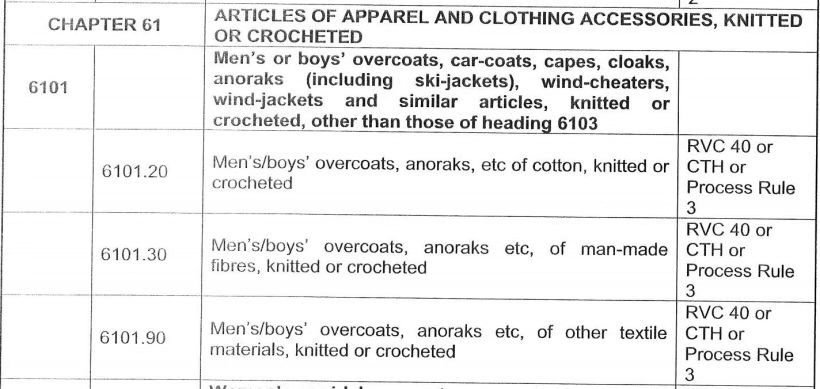

Chapters 61 and 62 are included in the Product Specific Rules (PSR) list; they are also included in the CTH list of general rules, ie Article 4, paragraph 1 (b). The PSR list and the CTH list overlap cover a total of 232 items of 6 sub-products, mainly in the two chapters of the clothing product.

The rules in the PSR list give the product greater flexibility to qualify for origin. In chapters 61 and 62, most garment products are subject to substantial changes as long as they meet one of the three conditions, thereby obtaining the qualification for origin. The new rules after the upgrade actually reduce the threshold for obtaining a certificate of origin.

For the products of Chapters 61 and 62 to obtain the qualifications for origin, you can choose not less than 40% of the applicable regional value components, four headings to change or specific processing procedures.

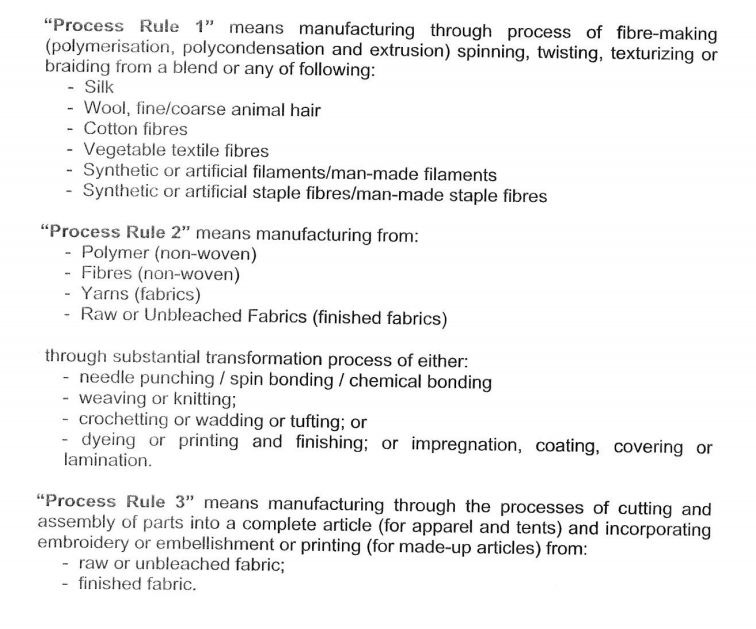

Note: Processing procedure rules

Rule one means “starting with fiber”;

Rule 2 means “starting from the yarn”;

Rule three means "starting from tailoring."

For products that are neither in the PSR list nor in the CTH list, only RVC40 (with a regional value percentage of not less than 40%) can be used to determine the origin of the product. If it is met, the eighth column of the certificate is filled with "% of actual area value", such as 40%

7227.20 Hot rolled wire rod of silicon-manganese steel

8515.21 Straight seam welding machine

These two products can only be judged using RVC40.

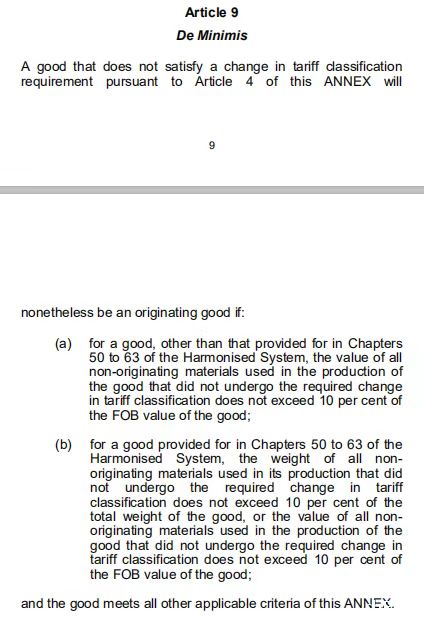

Added "minor content" rule

Article 9 (Article 9) of the revised Rules of Origin has added the “minor content” rule.

Article 9

Micro content

If the goods do not meet the requirements for the classification of tariffs as stipulated in Article 4 of this Annex, but the following conditions are met, they shall still be regarded as the original goods:

1. For goods other than Chapters 50 to 63 of the Harmonized System, the value of all non-originating materials used in the production of goods that do not subject to a defined tax change shall not exceed 10% of the FOB price of the goods;

2. For goods of Chapters 50 to 63 of the Harmonized System, non-originating materials that have not been subject to change in the classification of the goods are used in the production of the goods, provided that the weight of all of the above non-originating materials does not exceed 10% of the total weight of the goods. , or the value of all of the above non-originating materials does not exceed 10% of the FOB price of the goods;

And the goods comply with all other applicable standards of this annex.

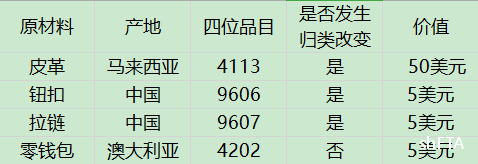

For example, leather handbags (HS 4202.21)

(This case is only used to explain how the rules apply)

Tax item classification change rules: Four items should be changed.

FOB value: $100

Judgment: Purchasing is the only non-original component that does not comply with changes in tax classification, as required by Annex 1 of the Protocol, Rules of Origin. The value of the coin purse accounts for 5% of the FOB value of the goods. Due to the micro-content rule, that is, the value of the non-original component does not exceed 10% of the FOB value of the goods, the handbag conforms to the definition of the origin of the China-ASEAN Free Trade Zone and should be qualified for the origin.

1. When the certificate of origin in the eighth column of the certificate is a percentage, the column 9 automatically displays the FOB value;

2. When the PSR of the certificate column 8 is filled in the PSR and the applicable regional value component (RVC) standard is selected in the reporting sub-standard (or RVC standard), the ninth column also displays the FOB value.

Original "Operation Procedures"

新《操作程序》

The importer's invoice number or third-party invoice number is optional, which simplifies the operation procedure and improves the efficiency of customs clearance.

Hot text recommendation

Practical information